What Changed and Why It Matters

Emm, a UK startup, raised a $9M seed round led by Lunar Ventures to build a “smart menstrual cup” that embeds ultra‑thin sensors in medical‑grade silicone to capture menstrual data. The company targets a 2026 UK launch and 2027 US entry, with 30,000 pre‑orders already on a waitlist. If the product works as advertised, it introduces a new, in‑situ physiological data stream that could accelerate diagnosis and monitoring of conditions like endometriosis-where one in ten women are affected and diagnosis often takes 7-10 years.

This matters because menstrual health remains poorly characterized in clinical workflows and datasets. Most wearables infer reproductive signals indirectly (temperature, heart rate variability). Emm proposes direct measurement inside the reproductive tract-potentially higher‑fidelity inputs for AI‑driven biomarkers, clinical studies, and personalized care pathways.

Key Takeaways

- Direct data source: If validated, Emm could provide a new class of time‑series menstrual biomarkers beyond what rings/watches can infer.

- Regulatory path will define upside: Device claims (“wellness” vs diagnostic/monitoring) determine UK MHRA/FDA classification, timelines, and reimbursement potential.

- Data governance is make‑or‑break: Menstrual data is highly sensitive under GDPR and US state privacy laws; “pseudonymized” is still personal data under GDPR.

- Adoption hinges on comfort, cleaning, battery/charging, and price-menstrual cups are growing but still a minority product category.

- Commercial models likely hinge on clinical partnerships and research networks; insurance coverage will require outcome data, not marketing.

Breaking Down the Announcement

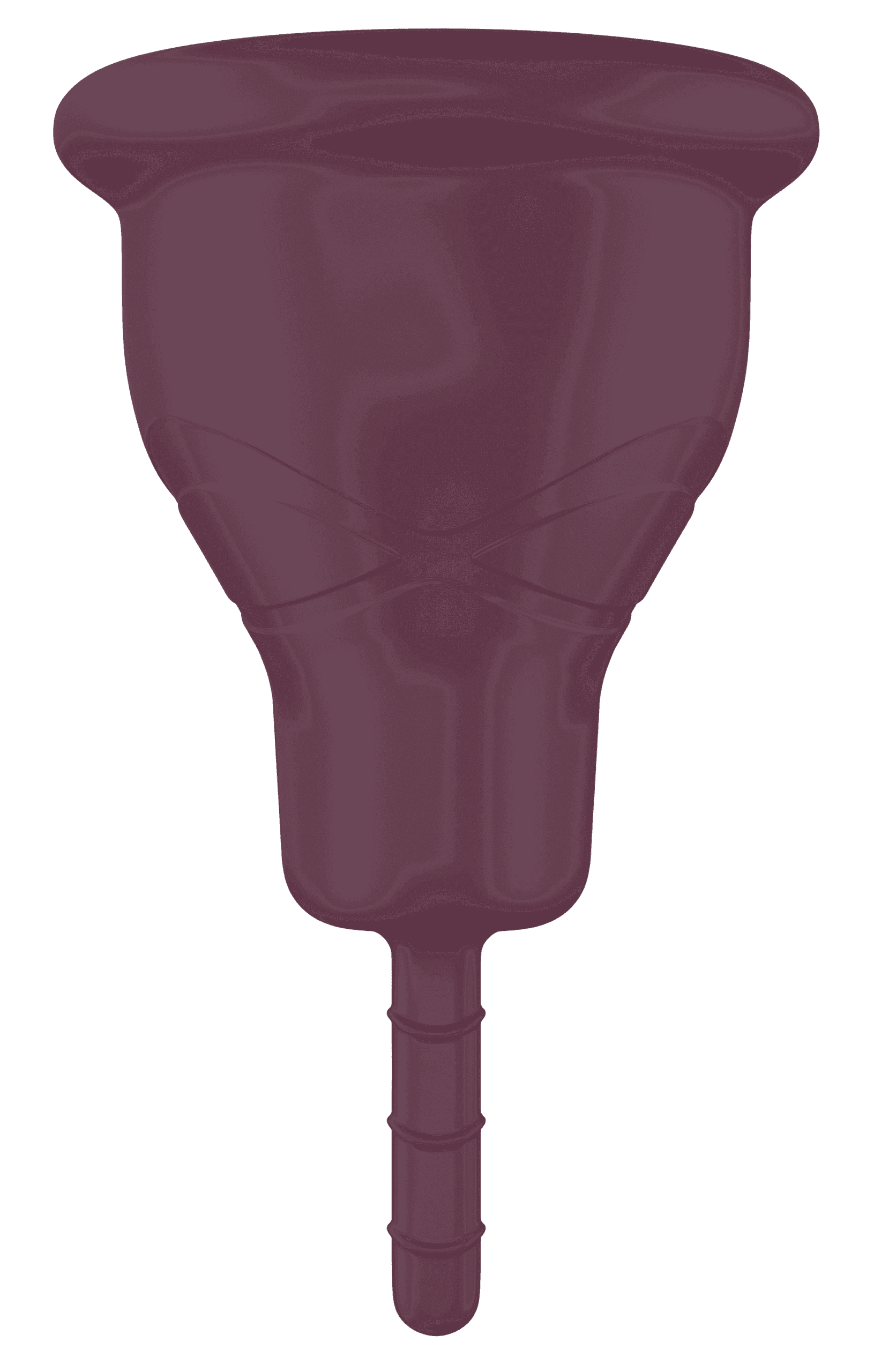

The prototype is a reusable menstrual cup with embedded sensors and an app that stores encrypted data with two‑factor authentication. Emm positions the device as a tool to track cycles and support research and diagnosis in reproductive health. Investors include Lunar Ventures (lead), Alumni Ventures (an investor in Oura), and BlueLion Global. Founder Jenny Button cites a five‑year development cycle and extensive user testing as the basis for a 2026 UK market debut.

What’s not yet detailed: sensor modalities, power and charging, sterilization workflow, and data transfer (BLE/NFC). These determine usability and regulatory scope. For example, standard cups can be boiled for sterilization; adding electronics necessitates removable modules or materials that withstand repeated high‑temperature sanitation. Battery life and charging must match real‑world cycles (multi‑day use, bathroom privacy constraints) without adding friction.

On the software side, Emm will need transparent data‑use policies, opt‑in consent for research, and auditable controls for secondary use. Under GDPR, menstrual data is “special category”; pseudonymization doesn’t remove compliance obligations (DPIA, purpose limitation, data minimization, cross‑border transfer controls). In the US, HIPAA may not apply to consumer apps, but the FTC Health Breach Notification Rule and state laws (e.g., Washington’s My Health My Data Act, CPRA) do.

Industry Context and Comparisons

General wearables (Oura, Whoop, Apple Watch) and cycle apps (Clue, Natural Cycles) rely on indirect signals or self‑reported symptoms. A few firms work with menstrual blood directly: Qvin has demonstrated lab testing from menstrual blood and secured FDA clearance to use menstrual blood for HbA1c testing; Daye and Evvy analyze vaginal microbiome via swabs/tampons. Emm’s differentiation is continuous, in‑situ sensing during menses, potentially offering flow patterns, temperature, or other features (to be confirmed) at higher temporal resolution.

Why now: femtech funding has matured, AI models need richer, labeled datasets, and clinicians lack objective time‑series data for conditions like endometriosis, adenomyosis, fibroids, and heavy menstrual bleeding. If Emm can turn raw signals into validated digital biomarkers, it could shift parts of reproductive care from retrospective self‑reporting to measurable physiology.

What This Changes for Operators

For health systems and researchers, Emm could unlock new longitudinal datasets: daily flow curves, symptom correlations, and response to treatment. That supports prospective trials (e.g., pre/post surgery for endometriosis) or payer programs focused on reducing diagnostic delay. If the device attains a monitoring or diagnostic indication, it could integrate into virtual care pathways and trigger interventions (e.g., referral to imaging, analgesic adjustment) based on risk scores.

For digital health and pharma, the data could improve cohort selection, endpoint sensitivity, and adherence tracking in women’s health studies. The commercial upside is significant, but hinges on robust labeling, interoperability (FHIR, EHR integration), and clear economic value—either via reimbursable monitoring codes or proven reductions in downstream costs.

Risks and Unknowns

Regulation: Classification depends on claims. A “wellness” tracker can ship faster but can’t market diagnostic capabilities; a diagnostic or monitoring claim requires clinical validation, quality systems, and regulator review (which could explain the 2026 timeline). In the US, reimbursement for remote monitoring generally requires FDA‑cleared devices capturing physiologic data with clinical oversight.

User adoption: Comfort, insertion learning curve, leakage, and cleaning are non‑negotiables. Electronics add complexity; any charging or cleaning friction could tank retention. Price sensitivity is real—standard cups cost ~$20-40; a sensorized device will need a compelling value proposition, likely a subscription for analytics and clinician review.

Data rights and trust: Emm promises encryption and limited access, but enterprise buyers will expect explicit research consent flows, granular data controls, and no default data sales. Pseudonymization isn’t enough; expect requests for on‑device processing, local data storage options, and independent audits. Cross‑border data transfers (UK/EU to US) must be contractually and technically safeguarded.

Recommendations

- Health systems and women’s health clinics: Explore a 2026 UK pilot contingent on clear intended use and IRB‑ready protocols. Prioritize endometriosis and heavy menstrual bleeding pathways where objective data could shorten time to diagnosis.

- Digital health/product leaders: Plan for interoperable data ingestion (FHIR, consent receipts) and model validation frameworks. Avoid clinical claims in UX until regulatory status is finalized.

- Privacy/compliance teams: Conduct a DPIA early. Demand data localization options, research‑use consent modules, and documented de‑identification pipelines with re‑identification risk assessments.

- Payers and pharma: Consider co‑funded validation studies tied to hard endpoints (diagnostic yield, time‑to‑treatment, reduced imaging/surgery). Reimbursement requires outcomes, not engagement metrics.

Bottom line: Emm’s $9M seed signals a credible push to turn menstrual blood from an overlooked sample into a continuous data asset. The opportunity is real—but its fate rests on regulatory clarity, frictionless design, and enterprise‑grade data governance.